Case Study

Eliminating Credit Card Fraud and Simplifying Reconciliation with graspPAY

Background

With over 35 years in the travel industry, Julia—Director of Operations at Frontier Lodging—leads efforts to streamline booking, folio, and payment processes. Frontier supports corporate and workforce travel across Canada and the U.S., often in remote areas where payment security and reliability are critical.

Frontier Lodging

Calgary, AB

Virtual Cards for Lodging

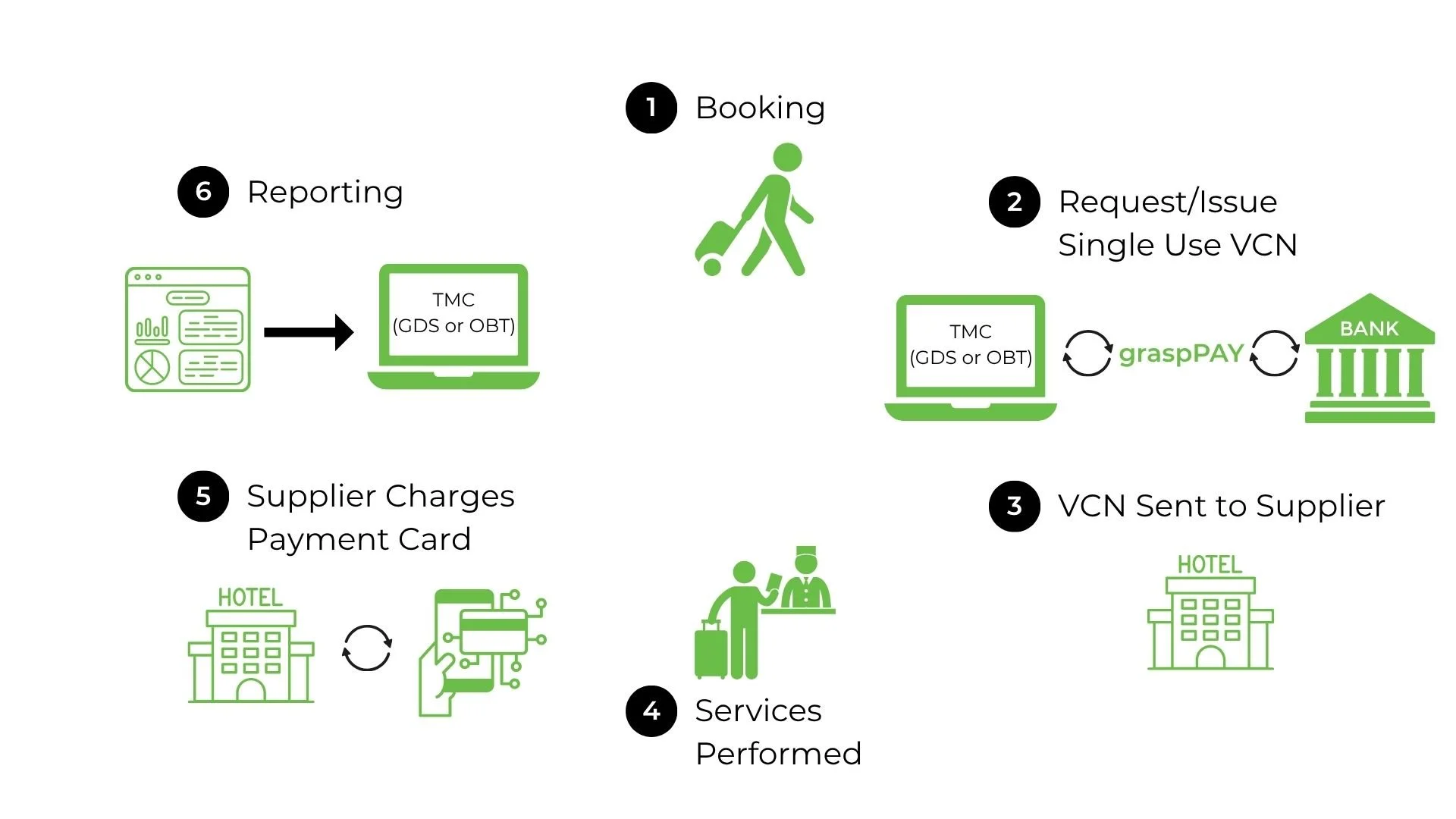

graspPAY Workflow

The Challenge: Solving Workforce Lodging Payment Problems

Traditional payment methods exposed Frontier Lodging to fraud, delays, and inefficiencies. Like many workforce travel providers, Frontier needed a more secure and efficient hotel payment solution. Traditional corporate cards created fraud risk, reconciliation issues, and check-in delays—prompting the need for a smarter approach with virtual payments. These issues didn’t just frustrate travelers—they impacted compliance and productivity.

Key challenges included:

Credit card fraud risk from shared or misused physical cards

Manual reconciliation between hotel folios and bookings

Check-in delays caused by mismatched names on corporate cards

Virtual payments offered a scalable way to reduce risk and streamline workforce lodging operations.

By switching to graspPAY’s virtual card solution, Frontier replaced physical cards with single-use, merchant-restricted virtual cards that:

Match the traveler’s name for seamless check-in

Limit charges to hotel-specific vendors

Enable automated reconciliation tied to each booking

graspPAY was deployed across both corporate and agency bookings, providing flexibility at scale.

The Solution

Near-zero credit card fraud since launch

Faster, cleaner reconciliation for finance teams

Better traveler experiences with no check-in delays

Broad adoption across North America’s remote lodging markets

graspPAY’s configurable controls and fraud prevention features have transformed Frontier’s hotel payment workflows—making them simple, secure, and scalable.

The Results

Get the full story with stats, insights, and lessons learned